The 3 Required Steps for Housing Allowances

As the year wraps up and your staff begins to think about the year ahead, they might want to re-think their housing allowance. Here’s a quick “how-to” to simplify that process!

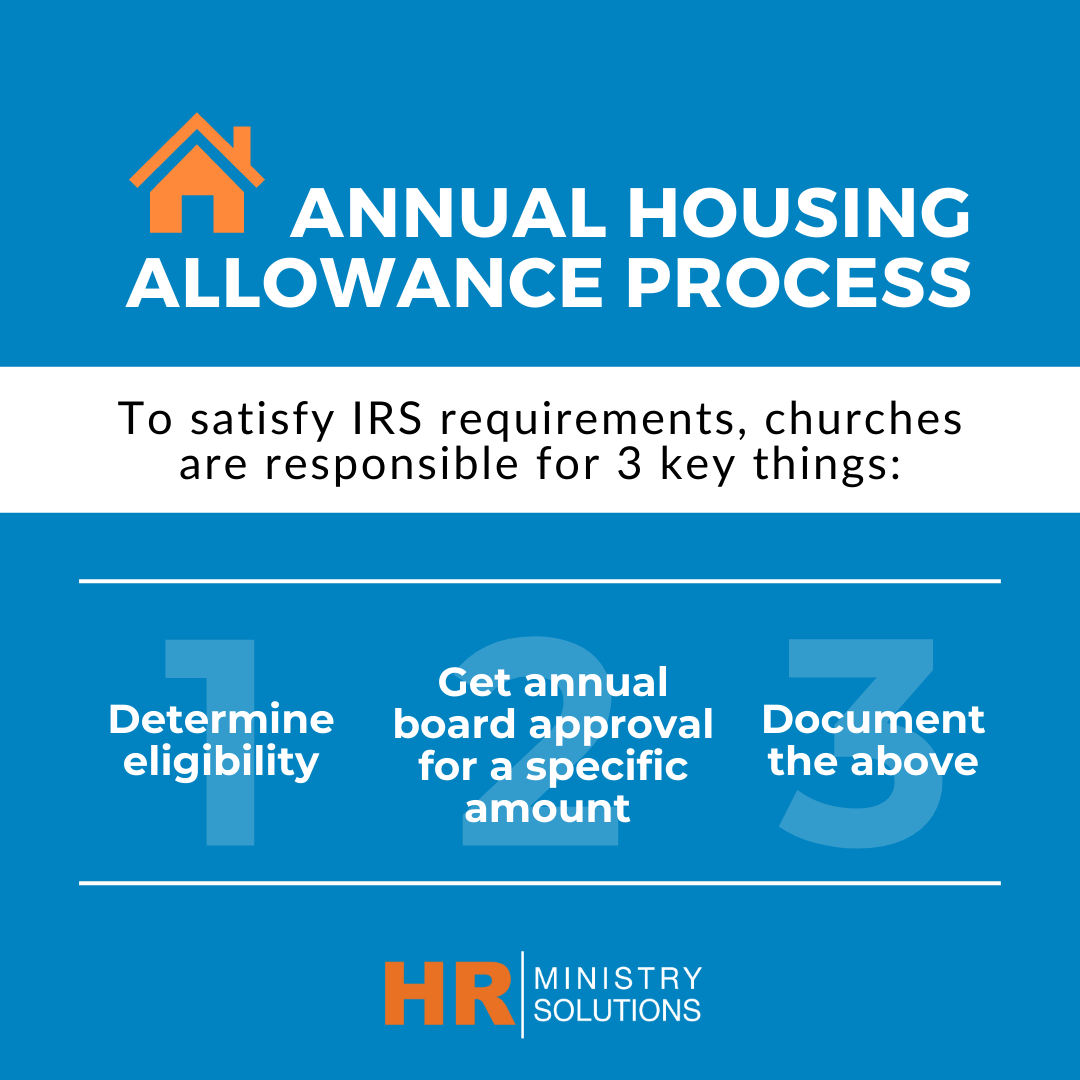

To satisfy IRS requirements, churches are responsible for 3 key things:

1. Determine Eligibility.

Ordained, licensed, or commissioned

Conducts ministerial duties

Has a level of authority in the function of the church

2. Get Board Approval for amounts submitted by any official, verifiable means, such as:

Record in the minutes of a board meeting

Ask the board to delegate approval of housing allowances to the Chairman of the Board or Executive Pastor

3. Document the Above. Keep the following in each minister’s employee file:

Qualifying credentials

Completed annual housing estimate

Proof of housing allowance approval

Remember the housing allowance follows the tax year, not the fiscal year and it is always future, never retroactive. Ministers are responsible for estimated housing, tracking the actual expenses, and reporting unused housing as taxable income. To help streamline your responsibilities as an organization, require your staff to use a standard worksheet like this one.